At KeeboMed Inc., you can discover a whole new world of different types of ultrasound machines and related accessories. The company offers a wide range of products. For your convenience, we have categorized the machines on the basis of brand, applications, used, veterinary etc. For small time physicians, veterinarians or medicos who have just started their practice it is not easy to install expensive ultrasound machines. For such situations, KeeboMed offers some of the most amazing financing options for its clients.

Partners Capital Group is a diversified, financial services company that provides creative leasing and financing programs for our customers. We serve a diverse range of industries and markets, providing customized approaches to meet the unique needs of manufacturers, distributors and end-users.

With an unsurpassed dedication to world-class customer service, our team of professionals have built long-term relationships with both vendors and end users.

Flexible financing plans available for all businesses

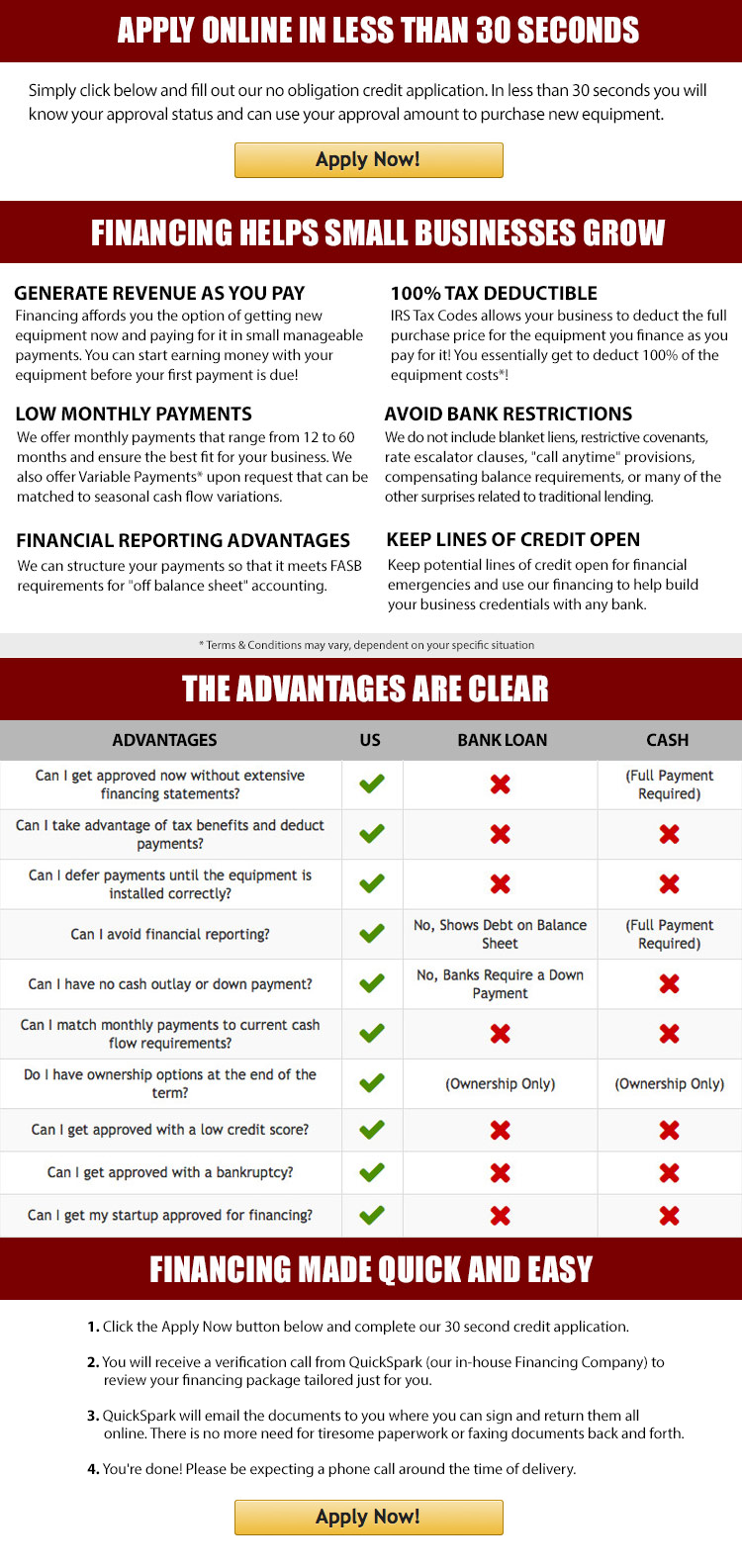

We understand that most companies have different financing needs when it comes to acquiring our product(s). We are happy to offer the following financing options to help you acquire and finance our equipment.

LEASES AND LOANS

○ True Lease – Operating Lease

Also called a Fair Market Value Lease, a True Lease allows you to write off each lease payment as an operating expense. When the lease term is up, you will have the option to renew the lease, upgrade the equipment, purchase it at Fair Market Value, or send it back.

○ Capital Lease

A Capital Lease is designed for you to own the equipment at the end of the payment period. We have created an easy way for you to purchase the equipment at the end of the term for just $1 (or $101, depending on your state tax laws).

○ Rental Agreement

We have the ability to structure an agreement as a Rental. Choose the term that suits your needs, commence the agreement and simply rent the equipment or software. Rental Agreements are a great way to overcome budget constraints.

○ Equipment Finance Agreement

EFA is a simple loan to your business that allows you to buy the equipment you need. Make your payments and at the end of your term, you are done. You chose what to finance including equipment, shipping, taxes, warranties etc.

○ Deferred Payments

Our unique 90 or 180-Day Deferred Payment Plan gives your company 90 to 180 days to build cash flows before having to make monthly payments.

FINANCING

|

|